todayAugust 16, 2021

All Posts Commodities People

All PostsConferenceDigitalisation & Technology

todayNovember 4, 2021 543 199 4

PANEL DISCUSSION

• How do I manage contracts in such different trading products?

• View of the ETRM community

• Handling additional volatility

• Looking ahead… What about hydrogen? Biomass? Biomethane? Helium? Ammonium?

MARC OSTWALD, Chief Economist & Global Strategist, ADM ISI

CHIRAG AHUJA, ETRM Support, Varo Energy

ANDRE JAEGER, SVP Product Management, ION

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

0:00

And welcome to this session on Dubai manager renewables with my existing infrastructure. Or do I? Do we need a complete technology, infrastructure rethink. My name is Marc Ostwald. I'm Chief Economist at ADM ISI. And I'd like to pass the well pass over for a brief introduction to first Andre and then Chirag to tell you a little bit about their background.

Andre Jaeger, SVP Product Management, ION

0:32

Perfect, thanks, Marc. So my name is Andre Jaeger. I started around 2004 at open links and actually joined an iron buyer the acquisition. I had various roles across the years started originally as an implementation consultants and moved into pre sales were kind of demo the product and kind of ended up eventually in product management. Got a global perspective of the market as well as the company worked a couple of years out of New York, London, and Berlin. Currently, I manage a cross product team of SMEs and market owners that manage the iron commodities portfolio says all about product positioning user group interaction, strategic roadmap and similar items. Currently, I'm working on a Berlin's and I have actually two bought Eric

Chirag Ahuja, ETRM Support, Varo Energy

1:31

Thank you, Marc. Thank you, Andre. Hi, my name is Chirag Ahuja, I started my career in EDR, M seven years back, I'm from the Silicon Valley of India, Bangalore. Currently, I work as an etrm analyst for borrow energy. I'm based out of Hamburg. And right now very exciting times for us in the era of space, in borrow as well, because we're sitting right at the cusp of the energy transfer transformation period, which is ongoing right now. Thank you.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

2:03

So just sort of a brief overview, I think one of the important things for this session is basically to compare and contrast, your what the differences are in terms of perspectives. From on the one side, the providers, and on the other hand, the end users. So we have two good people here to offer some insights on that front. First question would be, so this is quite obviously, quite broad, broad, but what are the key challenges to evolving and developing etrm systems for renewable power and fuels? Above all, given the additional complexity? Perhaps you'd like to kick that one off? Chirag as an end user?

Chirag Ahuja, ETRM Support, Varo Energy

2:55

Yeah, sure. Sure, Marc. Thank you for that. And actually, what I did was is I took the idea of the US justice system, where I thought there's wisdom in the crowd. And I asked this to my LinkedIn network of what did they feel about it? So I asked them, specifically what you asked what would be the biggest challenge on boarding, green energy on an ATR platform? So from the lowest to the highest? The least, was the spike in trading volumes. The network didn't believe that. Number two was lack of domain know how in it, does my it know what I'm really talking about? Number three, unclear business requirements was one of the answers of with the second highest votes. And of course, the fourth one with the highest most response I received was uncertain and changing regulations, which I think you have also touched upon quite a lot in your past or better panel. addition to this, I had also asked them what is the most key feature you want to see out of your etrm Managing renewables and, again, from low to high was handling large data sets. The second one was ability to integrate with other apps. The third one, and the fourth one, we're sharing the number one slot, which is reliable and accurate piano and nimble the changing requirements. But but here's the contradiction, which I feel I think etrm by legacy, by its nature has not is not inherent, to change very fast. It's not dynamic, because understandably, so billions of dollars worth of trade flows through it and you have to know exactly where if anything, breaks, where it's breaking, what is my exposure, cause. So I think there will be this continuous tug of war between being fast and being accurate. And I think Andrei would be be able to better off elaborate onto how he sees this tug of war playing out with his clients. And right?

Andre Jaeger, SVP Product Management, ION

5:09

Yep. So I can speak a little bit to kind of what we have seen based on the kind of existing client base and how we interact with them. So renewable transition is kind of one of the key investment drivers for us, because it's a strong focus off the existing client base. And I think as you said, Mark, we will distinguish between kind of, here's the client base that focus on the renewable power area, so utilities, commodity traders, but also new players that come to the market. And they'll know on the other side renewable fuels were some of the refiners marketers integrated oil companies play. And we actually run user groups, that we kind of utilized as a forum to discuss specific needs of our client community. And as usually in two areas, one is kind of back, best practice in the solution, kind of how it should be utilized, or is there something that we can package up for them? And the other area is, of course, kind of product, roadmap direction and investment, what do we need to do to kind of support the transition itself? If I think about it, what are the key areas that kind of came up in the user group or in the individual client discussion? And I think the first one I would mention is around certificates. And here, again, would distinguish between the two sites I mentioned before one that's kind of the renewable fuel fights, are we talking about rims, and that's a lot about that combination of what do you have in inventory? What did you blend and how to track the related certificates, then the ability to report that and to kind of be compliant to your particular regulation. And then on a renewable power site, it's more about green power certificates. So racks go three goes rocks of thirds. Carbon certificates are pre established. And I think they're quite simple to be modeled. But there's definitely more complexity on the green power side, we see on those kind of common transaction type, you buy yourself a certificate, you need to kind of Mali a production, you have an obligation demand. And you need to track inventory by the different kind of classifications. decent amount of variation by region. So that brings some of the additional complexities. So here, he will turn over x doesn't mean you're able to handle goals. So Wrexham or North America focus on more up, you want to kind of manage the registry side, so the scheduling or certificates, the ID tracking, and then hopefully get some type of automation, integrating that. And then last but not least, is position reporting. So aligning the obligation you have on the certificate side with some of the certificates that you have in allocated or currently in inventory. And you need to do it on a certain time bucket classification. The next area that we see was always kind of a big discussion topic is power purchase agreements, PPAs. That's kind of the contract for a post feed and terrorists world. And it's all about kind of getting appropriate financing for some of these investments. And we see again, kind of some common needs, on those contract types, but definitely some variation for different regions, depending on what underlying technology we have. And then, of course, what is the risk adversity of that particular client. So what of the better flexibility do I want to manage myself or which I kind of transferred to my counterpart, and then around the PPAs, one of the key aspects is to kind of manage the volume, so the time series, so it's long term contracts as basically long, long time series, usually small granularity hourly, or 15 minutes, you frequently want to update those forecasts to kind of have the latest and greatest on the CRM side, you need to manage your forecasts, you need to manage actuals, you get corrections. And that's kind of always linked to particular settlement itself. And then of course, complexity of the payoff for embedded volume, volume flexibility, again, some variation, because the pay is produced, pay as forecasted six volumes profile, nonlinear pricing, maybe some colors, some are just send an index or six price, certain penalties linked to volume. And then as I mentioned, to kind of get the position management get all the exposure, the ability to do scenario analysis, my kind of P 50 versus my P 90. And kind of evaluate that into context of my portfolio. How does my hedging look like in combination with different production level and be able to do that risk management aspect in relation to kind of the more traditional business itself and alive aspects. If a trade volume, I think that's something that's ongoing for a while, we have clients that kind of manage 10 to 50,000 trades a day, usually very small volumes.

Andre Jaeger, SVP Product Management, ION

10:12

Most of them kind of driven by some algorithmic execution. I don't think that's new, but it's just kind of more renewable transition more renewable generation, more need to kind of balance on the intraday side. And for the CGM is definitely key aspect to be able to digest that trade volume provided automate. But at the same time, the ability to reconcile on the lower granularity that always kind of speed and performance, I would say this is kind of the main items that we see in context, when we talk to the user group in relation to kind of what are some of the key system requirements from a from a system perspective, but definitely tell us to cover what she rock said, I think we still expect a lot of uncertainty, there's a lot of discussions around how certain things can be modeled, or what will be required in the future. So it's kind of good to have those in interaction with the users. And I think we will see continuous change, but this is the ones kind of we see most frequently at the moment.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

11:23

So yes, it's I mean, just to get an idea, I mean, what sort of order relative to say, something much simpler in well, simpler, I don't want to put this down, put this the wrong way. But the relatively simpler bits are and established. Hydrocarbon trading, your what sort of order of data requirements? Are we talking about multiplying up here? Your it clearly is a much bigger universe of data that needs to be managed. Do you want to kick that one off? Sure.

Chirag Ahuja, ETRM Support, Varo Energy

12:01

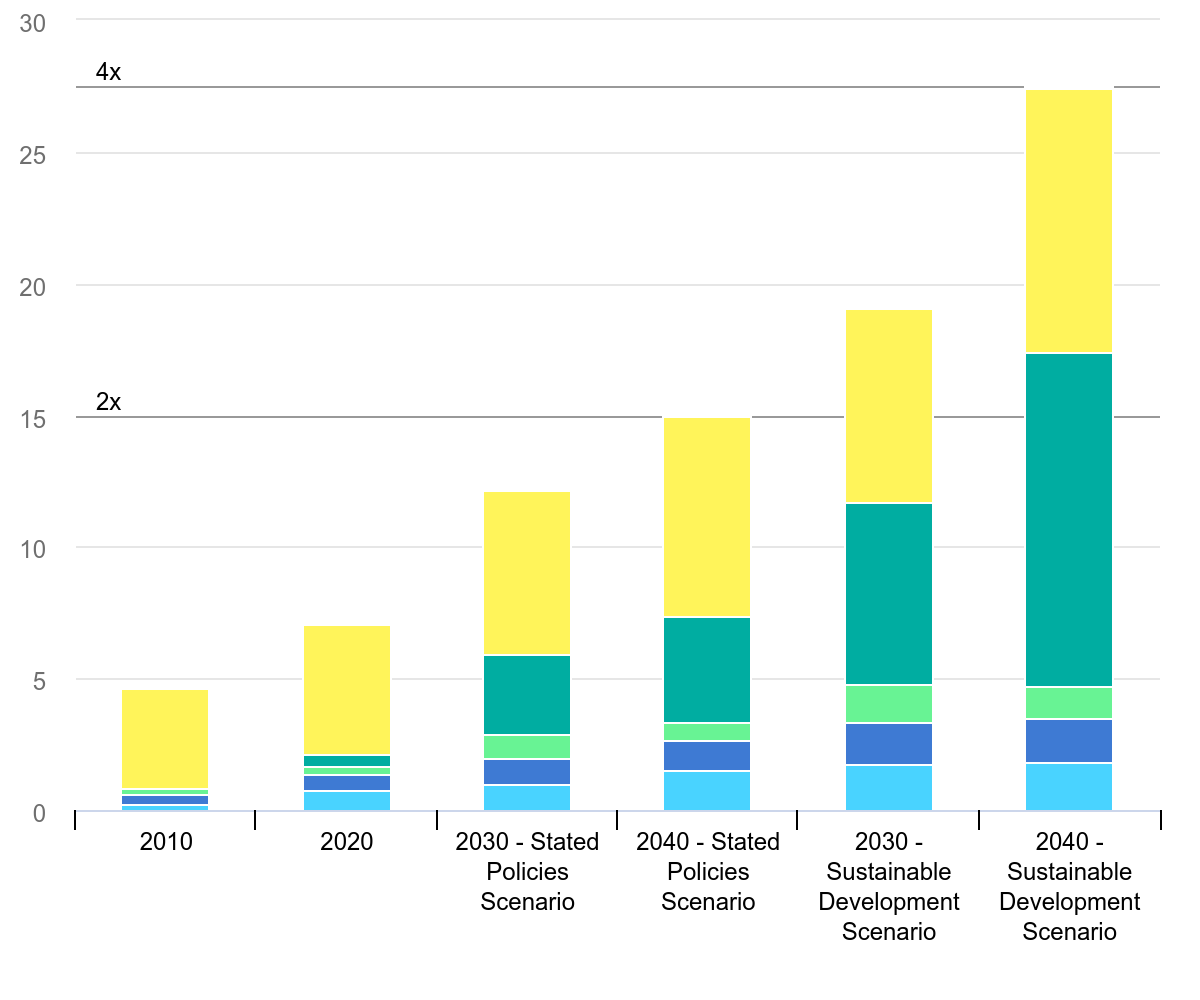

Yeah, sure, Marco. So most studies, which I've been through indicate that by 2050, the share of the renewable of the overall energy mix would go up between 20% to 60%. So depending upon, if you're a half glass full or half glass, empty person, you would take a view, presuming you're in the middle, and save 40% of the overall energy mix is renewables. And now if I translate that into into the average etrm application, that's, that's, that's a huge surge in the data within your etrm application, almost half of your data would be linked to renewables. And, and not only is the share of renewables going to be increased of the overall mix, but the the pie itself is going to be bigger by 2050. So we have this huge surge of data which is going to come in, and even the source of the data is going to change, I'm going to become very interesting, because another data point I gathered is that 13 out of 100 units of electricity, which would be produced in future would be from households, rooftop solar, stuff like that. So getting that into and capturing that would also play a role where your consumers are, in fact, hybrid in nature, we're also producers. So I think it would be very interesting to see this etrm systems being capturing this data, and then of course, doing the things it does on it. And it would, from my perspective, be very interesting to watch that.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

13:52

Andre, I'm gonna add a little bit to the question. And you you're providing these the solution, your if you could also sort of give us some light on how much you're reliant also on data providers, and how the complexity of adding that in and the fact that it's very new universe. Yep.

Andre Jaeger, SVP Product Management, ION

14:18

I think requirement wise, I think there's usually the the CTR c term is in the middle and needs to be capable of capable of digesting kind of a lot of inputs, but also generating some of these outputs and low granularity for further digestion and being able to combine with other datasets. So I think on the pricing side, power, I still think very similar, from a pricing perspective definitely has kind of initial market data on the certificate side. And there's kind of we'll be interesting to see how that plays out. What kind of combination of classifications really kind of result in different pricing terms. And there's a lot of classifications that we're currently talking about. And I just don't believe that that will be kind of feasible to manage five different technology, various different timeframe, how old the plan is, which region, it is sort of just kind of multiplying, if you think about kind of what price points you would need, in this particular case, we'll be interesting to see how that plays out. On the other on the data and volume management, I think he especially in the context of EPA has been able to handle forecasts. So you need to have a good forecasting tool. And you want to as frequently as possible, be able to kind of play that into the CRM to kind of have any downstream decision making and positions of metal, if it's p&l exposure or physical to kind of evaluating the latest and greatest what you believe is the most appropriate forecast that needs to be handled trade volume we talked about. And their mix, kind of being able to do some of these low level reconciliation without clogging any of the kind of speed of the system to kind of generate data, it's definitely kind of that ability to extract the data that are generated in the CRM and easily able to combine with I don't know additional weather data or make it accessible in the algo tool. So one is kind of ever fed the input side, the other one is also being able to quickly and possibly in real time to extract those data for further downstream consumer or consumption. I think that's the current one. I have, I agree with Marc on what he talked about the other area, which at the moment, we don't see too much being asked for, but we expect something coming, there's that whole topic of prosumers. Being able to kind of manage some flexibility, some storage side, if you think kind of bought broader Evie fleets in the future. And to kind of utilize some of that flexibility. In context of kind of how you trade and how you manage your portfolio itself. We'll be interesting to see how that's going with starting kind of initial discussion with clients about battery storage. But I would expect we see more trading, getting into figuring out how to manage some of these embedded flexibility and motion as a whole because that individually easy will not make a difference. But if I have a huge fleet, and I can utilize the flexibility to my advantage will be interesting to the utilize I bet in the future.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

17:38

Okay, and you were talking about developing this systems and to the sheer the increase in volume. I know your survey, your informal survey there provided the people that really think that trade volumes were an issue. But I'm just wondering, you know, we've gone through the disruption from COVID. Very variable, you know, sharp changes in demand. We've now gotten into a different phase where we've got this power crisis, not just in Europe, but actually around the world in China and Brazil, in India. Even in the United States, your are there other any your Have there been any gaps, which have shown been shown up as a result of this visit? If to some extent it's been a, I suppose, I suppose useful this word I would use? I think for some people it might be it's been a bit of a nightmare, but I'm just thinking as a stress test. It's an interesting one.

Chirag Ahuja, ETRM Support, Varo Energy

18:49

Absolutely, I couldn't agree more. And I'll give you a real life example of what happened in my case of, we had a requirement gathering session with a client where LNG had to be loaded into the trucks transported to the port, or the truck goes in onto Roro vessel roll on roll off, it reaches the destination, the truck goes out, reaches the retail unit. I had understood that my developer was on the call as well, who understood that, but then when we were designing and I was speaking with my developer, I told him, so LNG goes into the vessel, the vessel gets to the port LNG goes up. And this game of Chinese whisper happened. So now we design the code without the truck. Basically, it was LNG getting inside the ship, which is which now so now the ship became Q max, which was never the case it was row row. And, and then the algorithm, and you see the algorithm did not handle what was really required by the client. Fortunately, we had an early design review, where we visualize this on the board with him and with the developer And we realize no, this is not it. But I think from my perspective that is what is really missing, you can never do a proper whiteboarding session. We are WebEx in such a complex market. And I think, I think as offices reopen, and as things come back on, translating those requirements from the business user, to the business analyst to the tester and developer, and cutting across the whole lifecycle will, be very key. And I think this is put a lot more demand on on the business analyst or the consultant, where, where he or she has to play different roles within the same company one day, one day, they are a trader trying to test a new functionality in the front office, the next day, they are doing invoicing, the third day in nominations. So and of course, at the same time speak Java C and SQL. So that's a lot of demands from the from the from the consult, and these resources, as well as scarce and few. And you can see that translating into the market as well. So we have a huge challenge ahead in front of us where there's this massive transformation required when it comes to energy and bringing on green, and and such a few at such a short supply of the talent, which is required to get there.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

21:18

Yes, it skills shortages. It seems to be an issue pretty much everywhere in the world, partly because they're not not enough people are studying in universities, but also because we've got an aging demographic, you my personal view is that I think there's going to be a greater requirement to retain experience is going to be very important. But yeah, that's a side point. Well, how does this look from your perspective, Andre.

Andre Jaeger, SVP Product Management, ION

21:54

I think maybe the first point is just based on the market situation that we're currently in changing requirements, more volatility, we definitely see an increased demand for kind of putting a more sophisticated system in place. Kind of we interact with would love clients that using to come off or looking for kind of more sophisticated risk management tools to kind of manage some of the market changes or manage some of the volatilities and related exposure that they have. from a company perspective, I think in general, just in addition to the situation was definitely a little bit more challenging to kind of stay in touch with clients. I think we have decent setup with account management and our user group. But I think one of the points that I definitely realized, in the last couple of months, especially around renewable trends, transformation, we organized a set of webinars for existing clients to kind of go deeper into kind of particular capability that they can utilize on our products and kind of talk a little bit about best practice utilizing capability in the system. And that opened a little bit the eye in the context in for myself in the context of that there's a lot of clients that utilize some of the solutions that might be not aware of kind of what could be brought to the table or how it could be utilized in the most appropriate way or could be utilized in light of these kind of new requirements. And I think that's something that we have on the to do list to kind of figure out a little bit more how to better distribute some of those knowledge doesn't matter if it's kind of the client itself, or some of the third parties that work with our clients implementing our solution to kind of make sure that they are aware what is best practice, give them the right tools, maybe give some kind of pre predefined content at hand, to make it easier for them to kind of use the system from the best practice perspective. And then there's definitely some, some demand in this area, education wise, which I think fits very well was once you are upset about kind of dead SME accessibility and from a Windows perspective, I think we just need to make sure that it's distributed that's in our own interest, because otherwise you will get a lot of dissatisfied five clients because maybe they did something that negatively impacts user experience or performance. So floss to kind of re educate around best practice and how certain needs need to be addressed in the system.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

24:39

Okay, and yeah, I mean, it sort of moving on from that. How much is this whole lack of regulatory? Well, the well one, the lack of regulatory definition anywhere and then more broadly, the very the risk of some divergence between countries between regions. Obviously, one has to remember that different regions are going to have different sort of renewables product mixes. But how does that play into the complexity of setting yo, adapting the existing wall existing or adding to adding new etrm? Infrastructure?

Andre Jaeger, SVP Product Management, ION

25:36

First, yep. All right. So the first, definitely a challenge that we see across experience is kind of the variation on various instruments. And this sort of kind of a challenge, not just from a system perspective, but also from a business process perspective, but because usually you start with a business process. And the system needs to support kind of the implication of the business process. And that needs to be reflected in the implementation that needs to be reflected in the training side, that needs to be also reflected in the system. And you might run into situations that if it's an incapable to support this, and this, then might require to kind of think about, okay, we need to get a new system. And this is something we see definitely at the moment clients that come to us because existing systems are not able to support that kind of renewable needs, or maybe they come from a bulk commodity world and want to go deeper into power. So there's definitely some additional complexity that comes to the table or another great example is, as you said, kind of depending on how much renewable power production I have, it has totally different implications on the risk management side. So what if you think about it effect called cannibalization, if I work in a region where a lot of kind of renewable power is produced, and then suddenly, the winter flowing, or sun shining, everybody's producing at the same time more, which means that more production was correlated to kind of negative price effects because of just more supply. The other key aspect is this like that unknown unknowns, so we're clearly sure that there will be more changes coming down, and there will be more variations. And it's all about kind of having the flexibility to react to those kind of market changes. It's, then of course, important to have a system that has that flexibility. Otherwise, you run into situations that you might be dependent to wait on a particular vendor to kind of do some new development for your purposes, or you have to danger that the problem will be solved by the business side and XL are outside of their control structure landscape, which can be dangerous. So in summary, I would say it's definitely additional cost expense, that to deal with those variations will be nice. If, for example, certificates are more streamlined. That's definitely not the case at the moment, which makes it more complex. On the other hand, it's an opportunity to solve that particular problem more efficiently or quicker. It'll be quicker to market in that situation. So definitely more complexity, definitely some opportunity and definitely some cost related to achieving the opportunity itself. Sure,

Chirag Ahuja, ETRM Support, Varo Energy

28:33

yeah. Building upon what Andre said, though, and if I get your question correctly, Mark, how does one handle changes to etrm application? In my experience, I was watching this interesting podcast, two days back, it was about this jet fighter who was talking about how he how he takes on the opponent opponents jet. And, and says, and they have to deal with various different decisions and split second matters, he says that, I don't have to think it 100% True, I just need to take it 80% rule. And then the remaining 20% I maneuver, I change based upon how it plays out. So every step I gain a little advantage. I've seen that taking from that. Where it helps me as well is when there's a user requirement, of course i i First begin with the end in mind, and then try and see how do I give that 80% value and then immediately from the user as well you have some excitement and you have some feedback. So now they are on board with you now they are a partner with you in getting that change done. And I feel that that's been working pretty well so far, where they also see value in what the system is trying to do. And then at the end, you change that little 20% where they're also with you they're on board with you and you are able to reach where you require a little bit more faster?

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

30:04

Okay. And this is a sort of eternal theme, I think across the conference. But all of this is that I think there's sort of two questions. One, how much of an increase in costs? Are we talking about your? How much of it is related to development? How much of it is ongoing process management I permanent costs, as opposed to capital costs? And secondly, how do we deploy this across very different geographies? In terms of the strength of the relative economies we're asking developing economies, emerging economies to basically be on board with the whole renewable energy process? But you're given the cost background? That's why I asked the cost question first, you know, what are we talking about in terms of feasibility? Whoever wants to go first?

Andre Jaeger, SVP Product Management, ION

31:17

I can. Sorry, you know, I just need I think the other topic we discussed in this context of limited existing versus dedicated IT infrastructure, which is, I think, a little bit more closer to kind of my, my particular expertise in this case. And I think it's important to, work with capability that have some dedicated renewable focus. So key question, this particular case, that would imply also kind of making it easier for me and more cost effective to adopt this kind of, thus, my solutions that I have in house kind of support the changing needs of the energy transition itself. For myself, this is really a question is what is the focus of that particular vendor? Does he support the right commodity? And at the end, does that solve my transitional needs in this case? And as I said, for me, it's not kind of an existing versus dedicated IT infrastructure question, it's kind of clearly important to have specific capability to support that renewable transition. And for us, might be a little bit biased, kind of where I'm coming from. If that those specific need from renewable perspective, it's very important, at least for the client base that we work with that it kind of works in tandem with some of these generic teacher CGM capability. So they don't see necessarily the benefit of having a particular point solution because I have to PPAs I have to certificate I have the intraday kind of needs. But I want to combine that with an overall cross commodity risk management type of solution, I have back office needs that need to be solved, I have data management needs, and I want to have don't want to manage that then data in multiple system, I have a hedging program for my more traditional business versus my renewable activity, limit management, etc. So for us, it's at least kind of from a cost effective perspective, important to kind of support the community to kind of get the best of both worlds, get the dedicated focus with renewable capabilities, but combine it with kind of some more traditional CTMS to kind of keep it manageable. And as I said, I think there's still some some additional effort on RSI to better educate how to best practice utilize the capability. Of course, there's more items we always can do from a roadmap perspective. But that's at least how we kind of plan for our client base to kind of make it as painless as possible. Of course, we cannot address some of these kind of bigger problems you're talking about. But we definitely see that as an expensive items for a lot of our clients that need to be solved. Definitely often opportunity, but we want to make it as effective as possible for them.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

34:37

Sure,

Chirag Ahuja, ETRM Support, Varo Energy

34:38

I think Andre summed it up very quickly, if you could show the business value of either reduce costs or gain in time efficiencies or new opportunities arising out of the use of tech. I think then, I think cost is not such an important pleasure if you can really show the value But Mark, I think where your question comes from is a morphic economist, how you feel between developing and developed countries playing out in the transition. What from what I've seen is that developing countries argue is that it's not fair to them that the developed countries economies were built on hydrocarbon. And now the same is expected from them. But then at the same time, we are also seeing massive reduction in the cost of solar cost of PV and a fair trade of technology transfer. So hence, I think you see countries like China and India with massive, massive solar projects going on, right.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

35:47

So yes, is your suppose within all of this, that technology transfer? And ZTR? And systems are part of that technology transfer? Your how much is sharing that going to be a key issue?

Chirag Ahuja, ETRM Support, Varo Energy

36:12

I'm not sure to be honest, this is definitely not my domain. So thank you.

Andre Jaeger, SVP Product Management, ION

36:21

It's a good question. But I think it's also a mindset. It's not something that we haven't answered. I think we tried to kind of stay on top kind of where the markets is going even kind of places where maybe it's not as deregulated yet. Because that means that usually if you get kind of a market deregulated, there's a higher need from a risk management perspective. But yeah, I think there's a broader topic about CMS and kind of how to distribute the cost and kind of how to make technology accessible. It's definitely not something that's currently on on our agenda, specifically, but definitely something interesting to kind of consider and to kind of ensure that not taking advantage of anybody in this context.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

37:15

Yes, absolutely. Well, we are getting to the end of the session, I haven't seen any specific questions. So do you both have any last thoughts on the subject? You want to start Andray?

Andre Jaeger, SVP Product Management, ION

37:30

Sure, maybe forward looking, as I said, Leave something that always comes to our mind that talked about the unknown unknown since I think this is a key aspect for us to kind of stay on top. So thanks, Austin, the market, listen to such conferences is looking at publications, we try to stay as close to our clients to kind of leverage the user group and kind of the knowledge and the power that we have in our community, share, discuss best practice, talk about design, product investment, it's all about faster filtering out that individual needs and kind of industry needs. And this is where the user group is a great advantage, I believe, because you have that filtering out happening between clients directly. That sometimes much closer to the market than necessary, our business analyst. And the other key point for us is to kind of distinguish today's needs. So where's today's pain point, capability wise, worse is kind of where the business going tomorrow. And I think that needs to be for us, at least from a system it perspective, kind of a balanced investment, support some of the short term needs, but also kind of keeping an eye on where we going with our batteries prosumers where it's headed hydrocarbons going and that's the key challenge of my world. And my job is something where we think trying to doing a good job by working closely with the clients that are really even closer to the business itself.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

39:07

Chirag

Chirag Ahuja, ETRM Support, Varo Energy

39:09

Well, yeah, at the cost of one minute left, I don't know how to sum this up real quick, Satya, I would like to say that thank you commodities people for having this seminar. Thank you, Mark for hosting this. And Ray was a pleasure talking with you. And I really look forward to more of these such events. It really helps me get a perspective of different perspectives, especially the window perspective as well from our end, because I think a key role which will be played in future is for someone to be in between the client and the window. And I think consultant in house business analyst plays that role where where he can wear different hats to communicate with a vendor much faster, resulting in fruitful project outcome. Thank you, and thank you for having me.

Marc Ostwald, Chief Economist & Global Strategist, ADM ISI

39:55

Thank you both very much. It's been a great pleasure chatting to you both and getting no and I'm looking forward to keeping in touch and

Written by: Commodities People

Architecture Change management

labelAll Posts todayNovember 4, 2021

Topics include: • Data bottlenecks - a major blockage to the data and digitisation strategies of many trading firms. • How Gulf Oil have managed to mitigate this issue utilising [...]

labelAll Posts todayJune 21, 2024

Key Takeaways Businesses and homeowners can enjoy federal tax credits on solar panels, though they differ slightly in amount, qualifications, and time frame. Virtually any taxpayer can qualify for the [Read More]

Key Takeaways Solar panel costs depend on a variety of factors, including panel size and number, panel type, and installation complexity. Consulting with a solar panel installation company is ideal [Read More]

Key Takeaways Only a few electric cars with solar panels exist today, but more will likely come as technology advances. While solar panels may not be the future, solar technology [Read More]

Net Metering Programs in Massachusetts Energy costs are on the rise across the country, and Massachusetts residents have felt this over the past few years. And while solar energy systems [Read More]

Key Takeaways Solar panels are likely worth the investment, but you still want to do your own research to determine if they’re right for your situation and goals. A $25,000 [Read More]

Aberdeen, Edinburgh and Glasgow are reportedly the three contenders for the headquarters of GB Energy. The post Aberdeen, Edinburgh and Glasgow emerge as final GB Energy contenders appeared first on [Read More]

An Aberdeen Labour councillor said the "negativity" of local business leaders will be to blame if his party does not select the Granite City as the headquarters for GB Energy. [Read More]

SNP Westminster leader Stephen Flynn has called for clarity from the UK government over funding for the Acorn carbon capture project in Scotland. The post SNP leader Flynn calls for [Read More]

Sir Keir Starmer has warned it will “take time” to reap the benefits of clean power initiatives but stood by a claim that Labour’s plans will eventually drive down household [Read More]

Germany’s freshly-approved strategy to import hydrogen has been criticized by industry groups for ignoring the lack of credible pipelines to bring supplies of the clean gas from other parts of [Read More]

You‘re now in the Kids Zone: where children, parents and teachers can find all the fun, educational stuff we’ve made just for kids. Read on for free movie tickets, eco-friendly [Read More]

As someone whose job is to fix things when they go wrong, I wanted to talk about what happens under the hood - the issues that can occasionally crop up, [Read More]

On Saturday and Sunday night agileOctopus customers got paid for the energy they used after the UK hit record levels of wind generation. [Read More]

Nobody wants to be left without power, heating or hot water, especially as the weather gets chillier.Here's what to do and who to contact in a power cut – whether [Read More]

Sign up online and see how much you could save by switching. [Read More]

If you’re not pretty deep in the electric vehicle revolution, it’s easy to miss what is primarily making it happen. Going back a ways, the advent and then growing popularity [Read More]

Plants already do so many magical things. They are truly wonders of the world — as all life is. However, scientists continue to play with plants in order to reach [Read More]

Many auto companies reported 2nd quarter earnings this week and for the most part, most of the news was dismal with one notable exception. The post The Week The Global [Read More]

In the first 6 months of this year, 749 battery electric vehicles (BEVs) were sold in South Africa. A total of 931 BEVs were sold in the whole of 2023, [Read More]

Nine Projects Across Seven States Will Support Solar-Powered Production of Hydrogen and Lower Emissions from the Aviation, Food and Beverage, and Other Sectors WASHINGTON, D.C. — In support of the [Read More]

The urgency of the global climate crisis is driving Europe’s transition to a renewable energy system. However, the investment gap for adding renewable technologies and for updating its energy networks [Read More]

Energy security is not only a burning global issue, but a cornerstone of Ukraine’s future, and the recent Ukraine Reconstruction Conference (URC) in Berlin offered a glimpse into the possibilities [Read More]

Following the EU’s parliamentary elections on 6-9 June 2024 and with the war in Ukraine showing no sign of slowing, a pressing issue demands attention: the EU’s continuing active participation [Read More]

Scotland has been a pioneer in renewables, says Kirsten Jenkins. But the easy wins are over and the task of decarbonising Scotland’s economy is becoming steadily more difficult, as the [Read More]

With the European Parliament tilting towards the right after the EP 2024 elections, there is a significant risk that the EU may shift towards a stance less favourable to assertive [Read More]

By Tom Konrad, Ph.D., CFA Supply and Demand One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, [Read More]

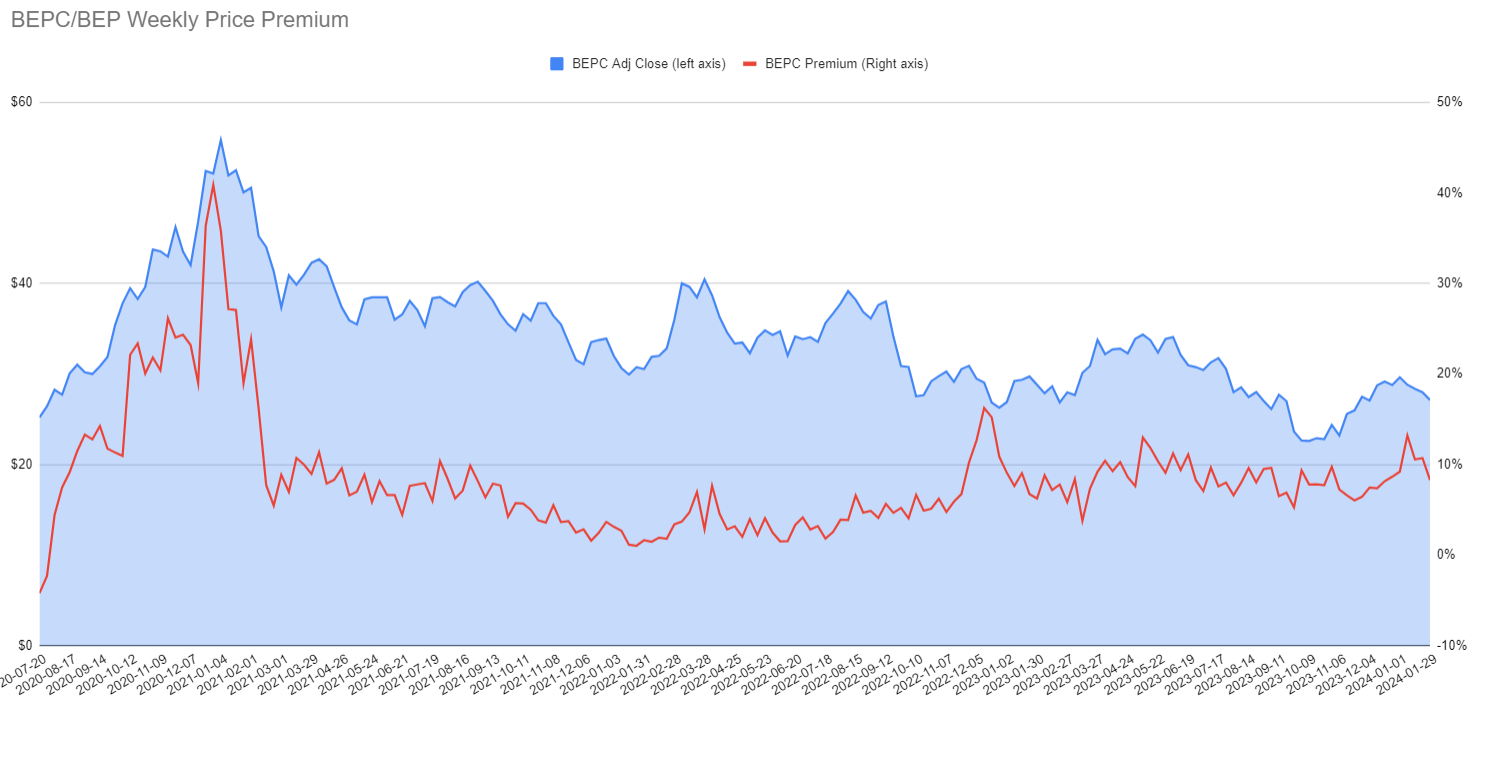

By Tom Konrad, Ph.D., CFA On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. [Read More]

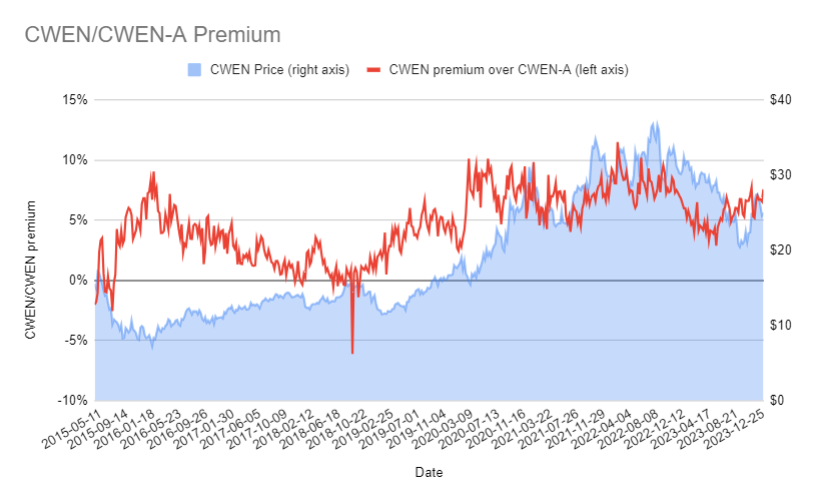

By Tom Konrad, Ph.D., CFA A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A [Read More]

By Tom Konrad Ph.D., CFA Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. [Read More]

I met VegTech™ Invest CEO, Elysabeth Alfano at the 2023 ESG for Impact Conference, where she made a strong case for investing in food and agricultural systems innovation as a [Read More]

If you’re among the third of Americans who rent their homes, you might think that there’s not a lot you can do to reduce your home’s energy use or lower [Read More]

Summertime is just around the corner now, and while you may be looking forward to sitting by the pool, grilling out with friends or going on a beach vacation, the [Read More]

Smart thermostats emerged more than a decade ago with first-generation models from ecobee and Google Nest and have since become one of the most well-known and popular smart home devices. [Read More]

If you’re interested in becoming a smarter, more empowered energy consumer, having a firm grasp on what your monthly energy bill is telling you is an ideal place to start. [Read More]

Over the last decade, energy companies have spent billions modernizing our electric grid. This has involved installing smart technologies, like smart meters and sensors, to optimize the delivery of power [Read More]

The race is on. Accenture explains why US energy companies will soon be fighting to be methane-mitigation pacesetters. [Read More]

A review of energy sector M&A approaches over the past decade sheds light on four inorganic growth pathways energy companies should consider. [Read More]

Accenture and the World Economic Forum identify five actions to get industries on track for net zero. [Read More]

Accenture identifies three IT enablers of innovation that upstream operators should develop or strengthen to remodel technology. [Read More]

Learn about the six key insights into why—and how—the energy transition must be accelerated. [Read More]

Root-Power has announced the appointment of Eclipse Power Networks and RJ Power for its Coryton Energy Park project in Corringham, Essex. [Read More]

Masdar has partnered with Endesa with a €1.7 billion renewable energy investment in Spain [Read More]

Ameresco Sunel Energy SA has announced its role in the construction of Lightsource bp’s 560 MWp Enipeas solar project in Greece. [Read More]

Siemens Energy has been awarded a contract to supply a 280-MW electrolysis system by EWE. [Read More]

Wärtsilä has been selected by Origin Energy to deliver the second stage of the Eraring battery facility at Origin’s Eraring Power Station in New South Wales, Australia. [Read More]

As the Paris Olympics begins, Mark Charlton at De Montfort University tells us how sport is being affected by climate change. Rising temperatures and weather events like flooding and droughts [Read More]

The Biden administration has reintroduced Trump’s tariffs on e-bikes from China. That’s 25% tariffs on imported e-bikes and bike components made in China. An additional 25% tariff on Chinese-made battery [Read More]

Producing sustainable e-fuels like ethanol and butanol requires the processing of biofeedstocks. Using microbes to chew their way through them is well known. Justin Rickard at NREL describes research there [Read More]

The world needs a large supply of renewable carbon to replace fossil feedstocks for hard-to-abate sectors like aviation, shipping, chemicals, food and beverage. Arno van den Bos, Karan Kochhar, Luis [Read More]

The new EU Emissions Trading System, ETS 2, covers emissions from buildings, road transport, and additional sectors such as fuel use in small industrial installations. It’s designed to reduce emissions [Read More]

Copyright 2023 Commodities People

ZETA

ASSOCIATION PARTNER

ZETA (Zero Emissions Traders Alliance), based in UAE, offers a meeting place and a public platform for companies and organisations with an interest in creating wholesale traded markets in climate neutral products. The vision is an emerging MENA ‘net zero emissions’ energy market including exports to neighbouring countries and globally.

ZETA proposes a suitable market framework and transaction tools, including standard contracts, with a view to facilitating climate neutrality in the MENA region and beyond. We expect the creation of markets and the use of market-based mechanisms will help achieve climate neutrality combined with energy security at least cost. ZETA assists our members in dealing with the transition from just trading fossil fuels and electrons to trading low carbon and renewable energy carriers and related certificates and guarantees of origin. ZETA aims also to help guide policymakers and influencers along a cost-efficient path towards ‘net zero’ emissions in energy value chains in the MENA region.

REDEX

SPONSOR

REDEX is a premier provider of sustainable energy solutions. Our mission is to drive the global transition to net zero by offering innovative technologies and expert services. With our core products REHash and RESuite, we are dedicated to reducing Scope 2 greenhouse gas emissions and creating a greener future for generations to come.

MOLECULE SOFTWARE

LEAD ETRM/CTRM PARTNER

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

MOLECULE SOFTWARE

LEAD ETRM/CTRM PARTNER

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Molecule provides next-generation P&L, and near real-time VaR and position reporting for companies that trade any kind of commodity. Molecule can be used for power, natural gas, crude oil, renewables, biofuels, liquids, metals, agricultural products, softs and FX futures/options.

RJC GROUP

EXHIBITOR

enspired

SUBJECT MATTER EXPERT

enspired is a fully digital power trading-as-a-service company headquartered in Vienna. We drive the energy transition by enabling our clients to bring flexible assets to power spot markets and capture their full value with our augmented trading services. Our platform for augmented trading is the fastest on the market and utilize AI models to leverage vast amounts of data in real-time.

The enspired team consists of leading algorithmic traders, data scientists and technology enthusiasts who firmly believe that the way power is traded will soon change drastically – in our world, there is no room for trading screens and traditional optimization. We are actively trading on German and the UK power markets, supporting customers in several countries in Europe and plan to expand even further

MCKINSEY & COMPANY

KNOWLEDGE PARTNER

McKinsey & Company is a global management consulting firm. We are the trusted advisor to the world’s leading businesses, governments, and institutions. We are passionate about taking on immense challenges that matter to our clients and, often, to the world. In the energy sector we serve traditional utilities, oil majors, renewables players, new entrants including start-ups, developers or water utilities.

Fuelled by digital technologies, we guide companies through lasting transformations to create the change that matters. As our industry experiences once in a century transition, we build and share knowledge and experience promoting the triple aim of sustainable, reliable, affordable energy for all.

SPARTA

GOLD SPONSOR

Sparta enables traders to identify opportunities with complete clarity and conviction. We are built by traders, for traders, so we know the competitive advantage you need is to be able to identify and capture opportunities first. We know that your current processes make that difficult. We know that maximising your speed to market will give you the edge. We know that you need intelligence and insights, not just data. We know that you want to trade, not just populate spreadsheets. That’s why we built the first and only all-in-one pricing, forecasting and live intelligence platform to deliver actionable, tradable market insights. Sparta sources and cleans high-quality data from world-leading brokerages and data houses, then analyses and interprets that data for you in real-time, enabling you to confidently determine where opportunities exist, maximise your speed to market and, ultimately, trade with conviction.

METDESK

EXHIBITOR

AEPIBAL

ASSOCIATION PARTNER

AEPIBAL, the Business Association of Cells, Batteries, and Energy Storage, is endorsed by the Government of Spain and supported by the largest European associations in the sector. Officially established on September 13, 2017, under the auspices of the Secartys association, the Spanish Association for the Internationalization of Electronics, Computer Science, and Telecommunications Companies, AEPIBAL encompasses the entire value chain of the sector. Its primary goal is to advocate for the interests of companies in the sector before national and European public administrations.

With its associates, AEPIBAL actively engages in consolidating relations with the administration and participates in shaping the regulatory framework of storage in Spain. It staunchly defends the capabilities of the industrial fabric in this sector. Additionally, AEPIBAL serves as a focal point for professional training and networking activities.

VTC ENERGY

EXHIBITOR

VTC Energy provides end-to end energy management solutions with a holistic perspective to make industries digitally transform and save cost.

Our flagship product V-Gen, energy trading management software, seamlessly integrates participants in energy markets with the market operator’s offerings, facilitating digital transactions across day-ahead, intraday, and ancillary services markets. It provides your energy trading transactions via EPEX and Nordpool with maximum efficiency and different offer breakdowns. With real-time integrations, web-based accessibility, and cost-effective installation, V-Market offers a fast, error-free, and centralized solution for energy market participants.

The next generation IIoT product V-Sensor collects huge amount of data coming from plants and translates them into value streams for energy processes. Real-time dashboards provide users a seamless monitoring experience with full of control over distributed devices all around the globe.

Our forecasting solution V-Forecast is a self-learning and self-calibrating system which is based on AI, Machine Learning and Statistical Models. It is powerful and accurate, yet easy-to-use and quick to implement. It can be up and running in hours or even minutes.

ENERGY ONE

SPONSOR

Energy One is a global supplier of software products and services to wholesale energy, environmental and carbon trading markets.

Listed on the Australian Stock Exchange (ASX:EOL) since 2007, but with more than 15 years of market experience, the Energy One Group of companies has a successful track record of providing sophisticated, practical solutions and services to Australasian and European companies operating in the fast-paced 24/7 wholesale energy marketplace.

The Energy One Group is the largest supplier of 24/7 operational energy services in Australia and the second largest in Europe. Combining software with a premium service offering gives Energy One an enviable position in facilitating the entry of distributed renewable energy into national markets around the globe.

Energy One’s suite of software products includes ETRM, process automation, automated bidding/nominations and algorithmic trading. In addition to software, Energy One provides services to operate their software and manage the operation of renewable assets on behalf of customers.

Energy One’s clients include energy retailers, generators, users, customers and traders ranging from start–ups to multi-national organisations. Its suite of products and services offer proven market solutions for European, UK and Asia-Pacific energy participants, enabling the management of their entire wholesale energy portfolio.

Energy One’s market operations services provide a 24/7 ‘follow-the-sun’ approach, where experienced and dedicated teams work together and act on behalf of customers across the world in scheduling and nominations for day–ahead and intra-day markets. Energy One’s team of industry experts specialise in each of the relevant technical areas and its network of local offices means that it can provide local support to its customers.

Over the last five years, several companies have joined the Energy One Group. These include Contigo Software Limited in the UK, eZ-nergy in France, EGSSIS in Belgium and CQ Energy in Australia. All businesses within the group will operate under the Energy One brand.

DIGITERRE

PARTNER

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

We deliver “Agility at Greater Velocity”, because we care about creating outstanding outcomes and because we take ownership for solving the toughest technical challenges. As a result of this approach, we typically deliver high-risk, high-profile and time-constrained projects in less time than competitors, often significantly so.

GMSL

EXHIBITOR

GMSL is the market leader in gas and power scheduling software, comprehensive 24/7 managed services and communications for the energy trading industry.

From our office in Cambridge, we work with more than 80 leading energy companies across over 30 gas and power markets, streamlining business processes.

Companies can rely on GMSL’s expertise, built up over 25 years. Our mission is to enable easy access to the energy markets, through high-quality B2B communications, software and 24/7 operations.

Our SaaS solutions for gas and power scheduling enables our customers to gain access quickly and easily to new markets and takes the complication out of managing the scheduling process. There’s nothing to install, and easy to use interfaces and an intuitive web front end gives the operator full insight into their portfolio status.

Companies wishing to focus on commercial activities rather than the day-to-day scheduling and operations can outsource this activity to GMSL. Our experienced and knowledgeable 24/7 Operations Team can provide a tailored service covering all aspects of scheduling and portfolio management on behalf of our customers for portfolios large and small.

Contact GMSL at enquiries@gmsl.co.uk to find out more.

ENERGY TRADERS EUROPE

ASSOCIATION PARTNER

Energy Traders Europe promotes competition, transparency and open access in the European energy sector. We build trust in power and gas markets across Europe, so that they may underpin a sustainable and secure energy supply and enable the transition to a carbon neutral economy. We do this by; working to improve the functionality and design of European gas, electricity and associated markets for the benefit of the overall economy, society and especially end consumers; developing and maintaining standard wholesale supply contracts and standardising related transaction and business processes; and facilitating debate amongst TSOs, regulators, policy makers, traders and others in the value chain about the future of the European energy market. We represent more than 150 member companies, active in over 27 European countries.

FIDECTUS

GOLD SPONSOR

GEN enables you to reduce your counterparty risk, increase your operational efficiency and scale. It also helps you to increase the speed of counterparty onboarding, improve your PnL and better manage your liquidity. We provide you tools to better manage your working capital.

GEN supports multiple standards as ISDA, EFET electronic Confirmation Matching (eCM), EFET electronic Settlement Matching (eSM) etc. Furthermore, you can connect easily and quickly to GEN via multiple channels as Restful API, SFTP, Email, SharePoint, cognitive OCR etc.) and formats (e.g. xml, json, csv etc.). That means you can handle and control all your inbound and outbound post trade workflows in one solution.

deltaconX

GOLD SPONSOR

deltaconX regulatory platform is an innovative software service catering for European Financial & Energy Market participants enabling our customers to meet various regulatory requirements all over the globe such as EMIR, REMIT, MiFIR/MiFID II, FMIA, US-Dodd Frank, MAS, HKMA, ASIC, etc.

Through full automation and dynamic error handling, reporting processes are massively simplified, minimising manual workload and human errors.

At deltaconX we harness technology to make regulatory compliance processes fast, easy and cost effective.

BroadPeak

SPONSOR

CAPSPIRE

PARTNER

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

cQuant.io

LEAD ANALYTICS PARTNER

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

cQuant is a team of senior quantitative model developers, experienced energy analysts, software developers and cloud infrastructure experts. Leveraging decades of energy experience, cQuant is committed to serving the present and future analytic landscape with the most accurate models and highest performance in the industry. The field of analytics is changing rapidly and cQuant is dedicated to offering the latest advantages to their customers.

cQuant.io

LEAD ANALYTICS PARTNER

Founded in 2016, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

cQuant is a team of senior quantitative model developers, experienced energy analysts, software developers and cloud infrastructure experts. Leveraging decades of energy experience, cQuant is committed to serving the present and future analytic landscape with the most accurate models and highest performance in the industry. The field of analytics is changing rapidly and cQuant is dedicated to offering the latest advantages to their customers.

ATMOSPHERIC 2G

EXHIBITOR

Atmospheric (adjective) – relating to the atmosphere of the earth or another planet.

G2 (noun) – In depth information about any person or thing; An intelligence report.

AG2 was founded to accelerate innovations in global weather and environmental insights for risk management. AG2 Trader (formerly WSI Trader) is the world’s leading weather decision support platform for energy trading. We intend to accelerate investment to continue delivering unique, market-leading insights to customers around the world.

VALUE CREED

SPONSOR

Value Creed is a unique team of energy experts with deep expertise in every stage of the commodity value chain as well as CTRM platform ownership from process design & software selection through run/operate maturity. Specializing in both complex projects and day-to-day CTRM managed services, we support thousands of CTRM users/ energy market participants 24/7/365.

As an ISO 9001 certified company and member of Inc. 5000’s list of America’s fastest- growing private companies, we adhere to the best quality management practices and you can rely on us to maintain our quality and stability in all advisory & CTRM services.

We are your partner as you contemplate business process improvement, platform implementations & upgrades, seek innovative ways to find solutions to complex problems, or look to take advantage of cloud hosting and CTRM automation solutions.

We are advancing the world’s energy system to become more sustainable, flexible and secure whilst balancing social, environmental and economic value. Customers rely upon our solutions to plan, build, operate, optimize and maintain their power infrastructure, whilst increasing overall flexibility and resilience.

Our Grid Automation hardware, software and services portfolio unites deep domain knowledge and innovative technologies that enable customers across the globe to optimize the critical systems that power, move and connect us. Our digitalization solutions are cost effective, agile and innovative, delivering control, visibility and stability for increasingly complex systems.

Through digitalization we can improve reliability and resiliency, and enable a wide range of sustainable choices.

DYCOTRADE

PARTNER

DycoTrade delivers high-end commodity ERP software solutions for commodity and trade companies all over the world.

DEXTER ENERGY

SPONSOR

Dexter Energy provides leading AI-based forecasting and trade optimization products that help short-term energy traders managing a RES portfolio reduce their balancing costs by up to 35%.

EMSYS VPP

GOLD SPONSOR

emsys VPP is a pioneer in the development of Virtual Power Plants and ranks as a leading international provider. Our sophisticated technology is offered as a Software-as-a-Service solution and digitally connects decentralized power generators, storage facilities and controllable consumers via a common control room. It is used by numerous energy suppliers and aggregators to monitor, remotely control, and profitably market aggregated electricity production.

enspired

SPONSOR

enspired is a fully digital power trading-as-a-service company headquartered in Vienna. We drive the energy transition by enabling our clients to bring flexible assets to power spot markets and capture their full value with our augmented trading services. Our platform for augmented trading is the fastest on the market and utilize AI models to leverage vast amounts of data in real-time.

The enspired team consists of leading algorithmic traders, data scientists and technology enthusiasts who firmly believe that the way power is traded will soon change drastically – in our world, there is no room for trading screens and traditional optimization. We are actively trading on German and the UK power markets, supporting customers in several countries in Europe and plan to expand even further.

ENERGY & METEO SYSTEMS

GOLD SPONSOR

With its precise wind and solar power forecasts and comprehensive consulting services, energy & meteo systems is one of the major international providers of forward-looking services and IT products for the market and grid integration of renewable energies. Power traders, aggregators, grid operators as well as solar and wind farm operators on all continents rely on our digital solutions and sound expertise to manage the energy transition.

EVENTUS

NETWORKER

Eventus provides state-of-the-art, at-scale trade surveillance software across all lines of defense. Its powerful, award-winning Validus platform is easy to deploy, customize and operate across equities, options, futures, foreign exchange (FX), fixed income and digital asset markets. Validus is proven in the most complex, high-volume and real-time environments of Eventus’ rapidly growing client base, including tier-1 banks, broker-dealers, futures commission merchants (FCMs), proprietary trading groups, market centers, buy-side institutions, energy and commodity trading firms, and regulators. Client’s rely on the platform, coupled with the firm’s responsive support and product development, to overcome its most pressing trade surveillance regulatory challenges. For more, visit www.eventus.com.

BBCG

SPONSOR

PUBLICIS SAPIENT

SPONSOR

Publicis Sapient was born in the digital age, so we’re perfectly placed to modernize and optimize the way companies work, or to change their business model completely. Our work enriches the experience of people who engage with their brand in either a B2B or B2C capacity.

Energy and commodities trading is where we started out, and we’re still going strong. We’ve disrupted a traditional industry, bringing it into the digital age and offering more choice when it comes to E/CTRM. Our digital utilities team ensures that new or existing services are modernized in ways that enrich the life of the business or the end consumer, whether that’s more efficient business processes or smarter interfaces to warm the home.

We’re big enough to lead, but small enough to empathize and take the time to demystify the jargon that creates hesitation around digital. The speed, quality and value of our work is unparalleled, harnessing an agile working method to ensure rapid, measurable and effective progress.

LeapXpert

NETWORKER

FIS

GOLD SPONSOR

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our more than 55,000 people are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

MARKET DATA ANALYZER – ENERGY EDITION

FIS® Market Data Analyzer – Energy Edition (formerly MarketMap Energy) provides validated, aggregated market information in a flexible framework. It improves forecasting, reduces operational costs and increases efficiency in data management, storage and access, leveraging our robust data warehouse featuring over 1,000 high-quality feeds offering comprehensive coverage of global asset

classes. At the core of our solution is Forecasting, Analysis and Modelling Environment (FAME), an analytic database management system (ADBMS). FAME is optimized for the storage and dissemination of time series. The platform is further extended with a series of application programming interfaces, toolkits, web services, connecting this big data time series container to downstream applications and desktop statistical packages. Our Clients Energy and commodity companies as well as utilities with a significant interest in energy benefit from Market Data Analyzer – Energy Edition solution. This empowers them to reduce data costs, reduce operational risk and modernize the data landscape.

EMULATE ENERGY

EXHIBITOR

The purpose of Emulate Energy is fundamentally to help households become smarter consumers, by reducing their electricity costs and enabling them to use greener electricity, while at the same time improving grid stability. This leads to everyone getting the electricity they need in the most efficient way possible. For example, our “virtual battery” costs much less than a traditional battery and has no environmental footprint. Instead of storing electrical energy and releasing it on command, it uses flexibility in electricity use. The end user saves money, you as a customer increase your margins, and society as a whole wins when we create sustainability together. Our goal is to make renewable energy 100% accessible to the entire world. Today Emulate work with some of the biggest energy retailer in Sweden.

Emulate is a SaaS company (Software as a Service) that was founded in 2020 with the mission to accelerate the global transition to clean energy. Emulate is headquartered in Scandinavia, a global center for energy transition. Emulate Energy focuses on solving one of the key challenges in the energy challenges – access to energy storage – by turning demand flexibility/demand response into a battery equivalent resource.

Tallarium

EXHIBITOR

Tallarium is a market data and digital solutions provider that enables energy majors, trading houses, banks, refiners and funds in OTC energy markets to improve trading performance and manage risk more effectively.

We provide our clients with the opportunity to see live and objective market pricing data that allows them to make better trade decisions faster and instantly respond to market risk.

Combining advanced data science and machine learning across hundreds of markets, we provide insight and clarity in opaque and noisy energy markets.

Swaps Aggregator:

Capture more value, faster than the competition.

Options Aggregator:

An immediate overview of market activity and depth.

Live Forward Curves: T-Curves:

Improve decision making without the data chasing.

RadarRadar

EXHIBITOR

We are RadarRadar (formerly Tradesparent). Experts in the commodity trade and processing industry. Operating in the most fundamental industries of the world, food, energy and other commodities. Since 2010, we deliver high profile projects for the world’s leading commodity producers, traders, and processors. We work with our clients to configure bespoke and extendable data solutions, enabling their successful digital transformation.

In today’s fast-paced information age, with insecurities about climate change, political developments, and increasingly volatile markets, it becomes more and more challenging to have access to the right knowledge in- and outside the company. This increases risks in the daily financial and physical operations, and challenges adequate and controlled decision-making.

RadarRadar provides your business with the knowledge it needs to succeed. As technology company we continuously aim to support our clients with strong data management and advanced risk tools. It is our mission to enable companies to unlock the full potential of their data to improve risk and margin management and boost performance.

RadarRadar. World leader in real time food & energy

MDX TECHNOLOGY LTD

EXHIBITOR

MDX Technology (MDXT) delivers OTC price sharing technology to the global trading community. Over 100 firms rely on our low-code, workflow and data connectivity platform to execute and exploit lucrative opportunities faster than their competitors. Whether you are a trader looking to build curves, manage positions and share pricing across global desks, or a broker looking to publish prices for customers to trade directly or launch an RFQ, we have out of the box and customizable solutions. MDXT is; fast to deploy, high performing, reliable, cost effective, easily configurable without the need for overburdened internal development resources.

We are true specialists in real-time data distribution with extensive pre-built functionality and knowledge to accelerate deployments.

Users include investment banks, energy and commodity trading firms, brokers, exchanges, asset managers, hedge funds, and trading venues. Headquartered in London we serve Europe, North America and Asia.

GLOBAL LNG HUB

LNG MEDIA PARTNER

MOONLIGHT IQ

PR PARTNER

Moonlight IQ is a highly specialised, global B2B strategic PR and marketing agency delivering results for our clients in the global financial and technology sectors. For over 20 years we’ve played a key role in clients’ growth and dominance of their market sectors, and in becoming stand-out award-winners. Moonlight IQ provides proven messaging, branding, and communication strategies, ensuring that your messages are clearly heard in the market. Our strategy is to establish our clients as market leaders in the industry and to highlight the unique values each brand brings to the market.

We use our expertise in the industry and wide network of relationships to get businesses in front of leading finance and technology publications as well as key industry players, your prospects, and clients.

ETRM SERVICES

NETWORKER

ETRMServices is a global organization providing trading technology expertise in the energy and commodity trading and risk management domain.

With locations in North America, Europe and India we manage customer needs through an optimized and blended team of on-site, off-site and off-shore resources.

We provide program and project technical services for the E/CTRM system of record, source systems and models such as generation and forecasting as well as target systems for reporting and logistics. Our integration practice covers end-to-end connectivity across the trading stack via our Enterprise-based Interfacing technology as well as up-to-date adapters to external exchanges, grids, confirmation systems.

MONTEL GROUP EXTERNAL EVENTS PROFILE

EXHIBITOR & MEDIA PARTNER

Montel Group provides everything you need to navigate your way through the volatile energy landscape. Bringing together expertise from across the sector, we offer a range of services including:

Founded on the principle of bringing transparency to energy markets, our solutions have been designed to make it easy for users to make sense of what is happening in this increasingly complex environment.

Visit our website to see how we can help you make the right decisions for your

business: www.montelgroup.com

VALUE CREED

EXHIBITOR

Value Creed is a unique team of energy experts with deep expertise in every stage of the commodity value chain as well as CTRM platform ownership from process design & software selection through run/operate maturity. Specializing in both complex projects and day-to-day CTRM managed services, we support thousands of CTRM users/ energy market participants 24/7/365.

As an ISO 9001 certified company and member of Inc. 5000’s list of America’s fastest- growing private companies, we adhere to the best quality management practices and you can rely on us to maintain our quality and stability in all advisory & CTRM services.

We are your partner as you contemplate business process improvement, platform implementations & upgrades, seek innovative ways to find solutions to complex problems, or look to take advantage of cloud hosting and CTRM automation solutions.

We are advancing the world’s energy system to become more sustainable, flexible and secure whilst balancing social, environmental and economic value. Customers rely upon our solutions to plan, build, operate, optimize and maintain their power infrastructure, whilst increasing overall flexibility and resilience.

Our Grid Automation hardware, software and services portfolio unites deep domain knowledge and innovative technologies that enable customers across the globe to optimize the critical systems that power, move and connect us. Our digitalization solutions are cost effective, agile and innovative, delivering control, visibility and stability for increasingly complex systems.

Through digitalization we can improve reliability and resiliency, and enable a wide range of sustainable choices.

MORNINGSTAR

EXHIBITOR

Morningstar is a trusted source in data management solutions that provide clients with actionable information in the energy, commodities and financial sectors. Our enterprise-level software enables you to access and analyze proprietary and market data to facilitate collaboration and help make better investment decisions. Traders, risk managers, IT, analysts, and executives look to us to power their enterprise and take action with confidence.

CAPSPIRE

LEAD DIGITAL TRANSFORMATION PARTNER

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

AFRY

SPONSOR

AFRY Management Consulting is committed to accelerating change towards a sustainable world in the interest of future generations. We are passionate about transforming industries and creating value for clients and society.

We strongly believe that change happens when exceptional people with brave ideas come together.

AFRY Management Consulting works globally to address challenges and opportunities in the energy, agriculture, metals, infrastructure, industrial and future mobility sectors through